Objectives:

At the end of the course, you the counselor will be able to provide the  counselee with the tools and methods to help that person or couple with a way to get out of financial debt and to help solve situations that are found in many financial crises.

counselee with the tools and methods to help that person or couple with a way to get out of financial debt and to help solve situations that are found in many financial crises.

Points to reference during counseling:

Many resources are available to a counselor to find information about finances. One of which we use at New Life Christian Counseling Ministry is Dave Ramsey’s material. He has a program to help a person to get out of debt and stay out. There are many methods discusses on the internet and if you go to many bookstores, there are shelves with either get rich quick schemes or get out of debt today. However, as we have learned, it is better to have a plan and implement that plan than to read and try to follow all the different programs out there.

As we go over this course, you will be able to see a plan that is proven and will work in any situation. This will help you provide a positive solution to financial crises in a counselee’s life.

Included materials for the counselor:

We will provide a computer program that you can work with to teach the counselee a way to solve his or her problem. In this program, you will have a budget, a proposed payout plan, a proposed savings plan, and a pay-off program that will show how much is left and how much progress is being made. You will also be able to help the counselee with the proper type letters to send out to creditors.

Biblical principles, as those you have learned in the earlier courses, are the basis for this counseling. By following principles in one’s life, measurable results will be seen, and when they are seen, it is easier to continue following. Remember, the main principle in Belief Therapy is “People do what they do because they believe what they believe.” By understanding this principle and knowing that change comes when there is real change, one can attempt to pass this on to another.

There seem to be three main areas that cause marital strife, Finances, sex, and religion. Many young couples do not understand the necessity to know each other and seek counseling before marriage, therefore run into problems when the “newness” of the marriage wears off. Once they take off the “rose colored” glasses and reality starts to sink in, they often find many incompatibilities that should have been discussed prior to the marriage vows. Today, many decide that is when to end the marriage instead of seeking help and ways to stay together. We are focusing on the financial crises in this course. Many people today do not know how to spend properly, nor do they know how to save.

A good thing to understand is that rich people save, poor people spend. You do not hear of Mark Cuban spending to keep up with the Gonzalez’s. At the same time, there will be some who attempt to look as rich as Mr. Cuban by spending way over their heads to have things. One of the first steps to help others understand is how to start a savings program and stick to it. And know why you are saving.

A counseling example:

Jose and Maria have been married for 4 years. They have one child and another on the way. They both work, Jose in construction and Maria is a legal assistant. They have separate checking accounts, with Jose’s paying the rent and utilities, Maria’s pays the food and upkeep (clothes, child care, etc.). Maria says she has to keep a separate account because Jose would spend it on things he wants.  Jose admits to impulse buying, but since they both work they both have their own money. Both of them complain that at the end of the month, they rarely have any money left and when an emergency comes up, they use their credit card or don’t pay a bill to pay for the emergency.

Jose admits to impulse buying, but since they both work they both have their own money. Both of them complain that at the end of the month, they rarely have any money left and when an emergency comes up, they use their credit card or don’t pay a bill to pay for the emergency.

Maria has come in because she is tired of always having to call the creditors and put up with no money when she thinks they should have some. And with the baby on the way, she feels that she will be unable to get the support from Jose she needs because of how he spends. She has mentioned she is ready to leave Jose if things don’t get better. She said Jose has mentioned he will come into the counseling sessions if it will help.

Another point is, Maria makes more money than Jose. Her education allowed her to get a better job and Jose, not having anything beyond a GED feels he cannot do better. Jose is resentful that Maria makes more and she seems to have more money than he does.

In a case such as this, you will have to understand what will work for them. If you do not follow the program yourself, you will not be able to help them go through the steps. Principles work, and we have to show that they do.

When working with a counselee and their finances, it is important that you start by laying groundwork or a foundation for them to be able to understand not only where they are, but why they are there to start with. In doing so, you help them to begin to see that there is a solution and it will be a positive one for them.

Regardless of how badly we want to just dive in and “start doing something about it, most people who go to financial seminars and such end up actually doing nothing with what they learn. In financial counseling, we will look at why we do what we do with our money. We will also learn the “Seven Baby Steps,” which have the potential of changing lives.

Ask the counselee why they think people have trouble managing their finances. This will help them see a little of themselves in their answer, and as you have learned in other sessions, it when the counselee sees it for him or herself that the understanding becomes real to them.

The main reasons most people do not do well with their finances are pride and selfishness. They don’t want to deny themselves the things that they want, even if it hurts them or their families. Along with that; they are afraid of being perceived as being poor, so they would rather live beyond their means than to limit themselves.

Here are some truths. Stress them to the counselee, if necessary have them write them down, but do not forget them.

- Rich people keep their money; poor people spend their money.

- Rich people live within their means; poor people live beyond their means.

- Everybody is going to have an emergency.

Only a fool would decide that they don’t have to prepare for an emergency because life has proven that we all will have emergencies at one time or another.

And in most cases, the emergency will be a big one. Any time that you have an emergency and do not have the money to cover the expense, it is big. It is guaranteed that the emergency will have the impact of throwing a wrench into any budget effort you may have underway. It is always possible that the emergency may cause you to lose your means of income. Currently, with so many people living beyond their means, many people are one paycheck away from being homeless.

At the very least people need to have 3 to 6 months of monthly income in the bank. This will allow “breathing room” for looking for another job. Stress to the counselees that things will never, “just work out ok.”

In helping Jose and Maria, they will have to develop an achievable plan and stick to it, no matter what. Another thing they must do is decide who is going to be the “manager” of the finances.

Understand that it will take at least three months, and possibly up to five months before the budget takes root and becomes a real part of your life. Up until then, you will struggle with it. Again, as with the points above, stress to the counselees do NOT start on a budget unless you are going to be serious about it.

How Does this Work in Reality?

In helping Jose and Maria, they will need to do a personal evaluation.

Ask them to list reasons why people who go to “Financial Management” classes and seminars do not follow up on what they learn. Ask the counselee to list things they will start doing in their own situations.

Baby Steps One and Two

In the case of Jose and Maria, and with any counselee, they need to start with the baby steps. Step one is to save a minimum of $1,000 to start an “Emergency Fund”. This fund is not to be touched except in actual emergencies, not for food, gas or normal daily expenses. Make it hard to draw from, but not so hard that they could not get to it in a real emergency.

This amount will be necessary to cover any em ergency which may occur during the period during which you will pay off your debts. Most pay-off attempts are derailed due to emergency expenses during the pay off period because the budget gets thrown out the window for a lack of consistency. You can get the money for your $1000 emergency fund by selling, selling, selling. If necessary, sell everything that is not required for your immediate sustenance. You can also get more money by getting a part-time temporary job just long enough to raise the $1000. In order for the process to work, it will require dedication and a true desire to get out of debt.

ergency which may occur during the period during which you will pay off your debts. Most pay-off attempts are derailed due to emergency expenses during the pay off period because the budget gets thrown out the window for a lack of consistency. You can get the money for your $1000 emergency fund by selling, selling, selling. If necessary, sell everything that is not required for your immediate sustenance. You can also get more money by getting a part-time temporary job just long enough to raise the $1000. In order for the process to work, it will require dedication and a true desire to get out of debt.

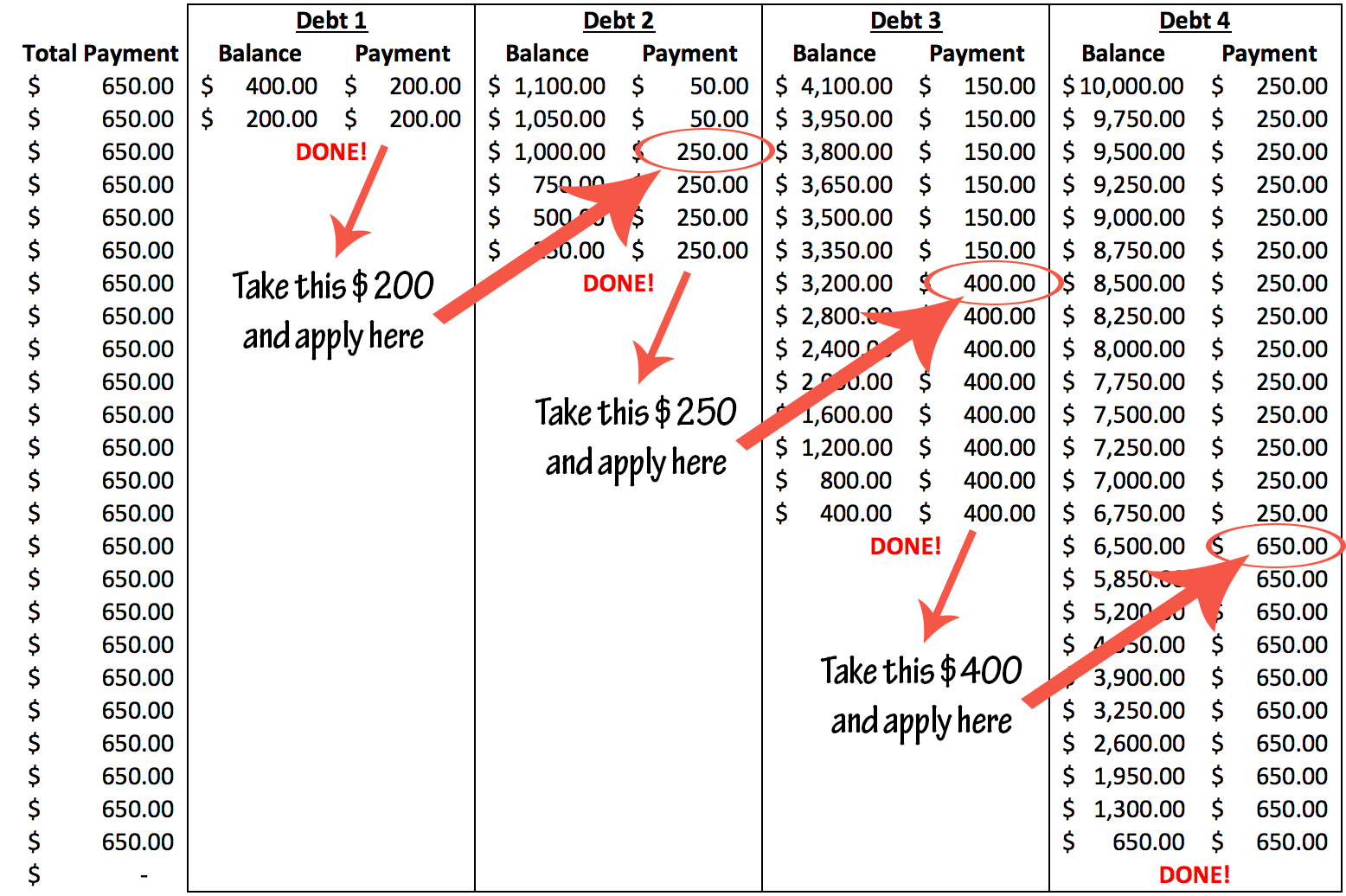

Step two. Complete a Family Budget Workbook and a 12 Month Daily Spending Workgroup. Using the forms/programs, fill out all the information. Make a list of all your debt which can be paid off. List the debts from the smallest amount due at the top, with the largest amount due at the bottom. Concentrate all your available monies on paying the first debt until it is paid off, without stopping or reducing your payments on the other debts (if possible). As you pay off a debt, remember that the amount you were sending is not now “free” money. To stick to the plan, you need to add that amount, and all available monies, to the payment of the debt that is next on the list. Keep on making the payments, adding the monies from previously paid off debts to the next existing one on the list until all the debts are paid off. Divert all “extra” monies to the Emergency Fund. Pay off all debt using the “Debt Snowball”.

A discussion on Tithing, Offering, and Giving Shooting Ourselves in the Foot

PRINCIPLES:

- You cannot gain God’s blessings in an area where you are violating His principles relating to that very thing.

- You cannot gain by sacrifice what you lose through disobedience.

The Bible on Money

Jesus preached on two subjects more than anything else in the Bible: Hell and Money. Of these two, he preached more about money. Why? Because He knew how money was going to impact the world. God’s teaching concerning money and finances is found throughout the whole Bible. The book of Proverbs is an excellent book to get bite-sized teaching on finances. The biggest problem with lots of Biblical teaching on finances is that too often the principles may not actually and specifically include the words, “money,” “finances,” or other such words in them. For example, Luke 6:38 (KJV) states the following, “Give, and it shall be given unto you; good measure, pressed down, and shaken together, and running over, shall men give into your bosom.” For with the same measure that ye mete withal it shall be measured to you again.” That verse is not specifically about money. Its primary intention is to help the reader understand that how we treat others, or what we do to and or for them, will have a direct bearing on what we get in return.

Notice:

Luke 6:38 (AMP) Give, and [gifts] will be given to you; good measure, pressed down, shaken together, and running over, will they pour into [the pouch formed by] the bosom [of your robe and used as a bag]. For with the measure you deal out [with the measure you use when you confer benefits on others], it will be measured back to you.

Luke 6:38 (MSG) Give away your life; you’ll find life given back, but not merely given back given back with bonus and blessing. Giving, not getting, is the way. Generosity begets generosity.

Another example is, “Can two people walk together without agreeing on the direction?” Amos 3:3 (NLT).

Primarily this verse is about being sure we understand each other and God enough to work well together.

On the other hand, it also helps us understand that God has a covenant with us. He understands the covenant, and will not violate it. He expects us to keep our side of the covenant. If we don’t keep our side of our covenant with God, why should we expect Him to bless us financially anyway? Obeying in one area, but disobeying in another, is still disobedience.

For example, If we tithe faithfully, but are stingy with our offering, but then give generously to a missionary, will God overlook the stinginess in our offering and still bless us for the other stuff? No, God cannot bless disobedience; He would be violating His own Word. Remember the principle, “You cannot gain God’s blessings in an area where you are violating His principles relating to that very thing.”

Good intention does not make up for disobedience or disregard. Many God-fearing, good Christians, would never even think of stealing. They would not consider withholding their tithes or offering. In fact, these Christians would often give more than even God requires, but then many will turn around and cosign for a son or daughter or some other relative.

Notice what God has to say about it: Proverbs 6:1 5 (NLT)

v1 My child, if you have put up security (co-signing) for a friend’s debt or agreed to guarantee the debt of a stranger

v2 if you have trapped yourself by your agreement and are caught by what you said

v3 follow my advice and save yourself, for you have placed yourself at your friend’s mercy. Now swallow your pride; go and beg to have your name erased.

v4 Don’t put it off; do it now! Don’t rest until you do.

v5 Save yourself like a gazelle escaping from a hunter, like a bird fleeing from a net.

So what do you think, is God going to ignore His Word and bless you anyway, because you had only good intention to try to help someone in need?

There is no such verse as “God helps those who help themselves.”

But, the closest verse to that effect is found in Matthew.

Matthew 25:29 (NLT) “To those who use well what they are given, even more will be given, and they will have an abundance. But from those who do nothing, even what little they have will be taken away.”

If you do not make the necessary effort to manage your money correctly, then why should God bless you with more? Is this verse clear enough? It seems that God is saying that the rich will get richer, and the poor will get poorer, is that what it says? No, but He IS saying that those poor people who do not learn to manage their money correctly, will lose even the little they have.

Why? Is God saying that just because a person is rich that they deserve to get more? No! He is saying that if those rich people will manage their money right, then they deserve to get more money. So, applying this principle to those who are not rich as of yet, is God saying that if those who have not, manage their money correctly, that they deserve to get more? Yes.

Even more than that, the more they get, and the better they manage it, the more they deserve, and the more they will get. The money you get every week, who does it belong to? If you are a Christian, the Bible says this: “… You do not belong to yourself, for God bought you with a high price…” 1 Cor 6:19 20 (NLT).

If you belong to God, then to whom does the money you get each week belong? That’s right, to him. Isn’t God great that He allows you to use 90% of that money for your own benefit? He could demand all of it and be within His rights.

How does He want you to use the 90%?

“Tithe” to yourself.

- Put money into a savings account each paycheck.

- This is going to be the primary way that God will provide for you in emergencies.

- If you do not do your part, why should you expect Him to do things for you?

- Your “tithe” to yourself can start with whatever you can afford at the moment, and then increase it to the point that you are saving 10% of all your earnings.

Give, offering, and “giving.”

The offering is given to your church for additional expenses, as God gives to you.

You get to decide how much.

- Just remember, “Give, and you will receive.

- Your gift will return to you in full pressed down, shaken together to make room for more, running over, and poured into your lap.

- The amount you give will determine the amount you get back.” Luke 6:38 (NLT).

“Giving” is done for missions’ work. This is work done on the mission field wherever that may be.

You get to decide where to whom, and how much, but remember the same giving principle applies to this as well. Giving is done to the poor as well:

Proverbs 19:17 (NIV) He who is kind to the poor lends to the LORD, and he will reward him for what he has done.

God wants you to choose to live at the level of the remaining amount, which will continue to grow as you manage your money according to God’s principles.

It may not be much when you first begin, but if you are managing your money correctly, 80%, though it will always stay at 80%, the actual money amount will continue to increase.

Notice:

80% of $100 is $80.

80% of $500 is $400.

80% of $1,000 is $800.

80% of $5,000 is $4,000.

80% of $10,000 is $8,000.

Do you think you could live on 80%?

IF YOU ARE NOT GOING TO BE SERIOUS ABOUT YOUR FINANCES, DO NOT CONTINUE THIS COUNSELING.

“Walking Together”

Rules to follow to maintain a healthy relationship with your spouse, your bank account, and your health.

First, choose who will be the “manager.” The manager gets to decide the how, and where, for management. For example, what bank, what system to follow, etc. All expenses must be listed on the budget sheets (no exceptions). Each person is to be allotted “spending” money (a fair, but not large, amount). All purchases, which are not already listed on the budget, and where the money does not come from the “spending” money, must be agreed upon by both persons, without exception.

Remember the principles:

- You cannot gain God’s blessing on something when you violate His principles relating to that thing.

- You cannot gain by sacrifice what you lost through disobedience.

Know your priorities. Allot enough income for the essentials (shelter, utilities, food, medical, savings). Make your spending habits consistent. Large expenses should be prorated over a period of time.

Live at the level of your wages. Make adjustments, cut things off if necessary, don’t let pride or fear control your choices and decisions on what cuts to make. Look for ways of saving money on expenses and eliminating nonessential expenses (entertainment, cable or satellite, cigarettes, needless shopping). Make the budget a family project. Everyone must be involved in order for it to work.

- Refrain from using credit to subsidize your income.

- Eliminate Credit Cards as much as possible (completely would be recommended).

As the counselee begins to take the steps to gain control of their finances, they will need to contact the creditors. Information to include in letters to debtors when desiring a reduction of monthly payments:

- Acknowledge your debt and desire to fully pay for it.

- Clarify the reasons you feel that you need to send a smaller amount per month.

- Do not take on an adversarial attitude in the letters, “begging, and groveling work better.” In other words, be nice.

- Stipulate that you have included a check for the smaller amount and that you will consider their acceptance and cashing of the check as agreement on their part with your request for the monthly payment to be reduced without negative ramifications.

- Remember that they are NOT obligated to agree with you, or make any changes. The contract you sign when you got the credit is fully enforceable in court.

- Keep in mind that they are called CREDITORS and you are a DEBTOR.

- Make offers that are realistic, but still fair to you.

- If you are able to meet with them in person, do so. If not phone them but keep precise records (names, dates, titles, agreement details, etc) and follow up the conversation to that person with a letter. But in the end, the best form is by mail. Registered and return receipt.

Training the counselee how to set up the expense and budget sheet

Don’t forget to include all debts (even if it was just a loan from uncle Bob). List all intended expenses (including, any hoped-for purchases) which will or may affect the budget. If the income amount fluctuates the use the smaller of the two, or an average of the two as the reference point for setting budget limits.

In helping Jose and Maria, some of the items that were discussed are the reason for the two accounts. When they were married, they became one. By having the separate accounts, they were still leaving an open door to escape. To be serious in handling their financial problems, by combining the income, and acknowledging the responsibility for both of them in taking care of the finances, they were taking a good step in the marriage as well. Since Jose was willing for Maria to be the “manager”, as long as both of them had to agree on purchases that affect the budget, he also agreed he had to control his impulse buying.

A point to remember, when dealing with financial matters, it is many times a result of past events that cause a counselee to react or act the way they do. People do the things they do because they believe the things they believe. In this case, Jose also was counseled on why he spent money the way he did. He was raised poor and when he was growing up, he made a decision that when he was able to, he would buy what he wanted when he wanted because he was not able to when he was a child. Once he realized that this spending was creating the financial burden, he decided that the family came first. Maria was insecure and she kept the second account because she had seen how her family fought over finances. She decided at a young age that she was always going to keep her money separate so she would not have the same problems. As she understood that as a husband and wife, they are one, they could not hold back from each other.

It is not easy to just change and get things taken care of overnight. One thing as a counselor, you need to realize that sometimes, the person/s coming in for counseling have had some unhealthy habits for a long time. Sometimes it takes a while for the principles to sink in. In the case of Jose and Maria, it took a while for them to be comfortable with just one family checking account, as well as a separate saving account. However, as with most counselees, once they started to see progress in their lives, it became easier because the principle became real to them. It replaced the truth.

Another point is that there will be bumps in the road. Emergencies come up, have to be dealt with. However, by continuing the budget and steps, each time an emergency came up, they went back to the basic payments and built up the emergency fund again.

Finance Counseling Commitment Contract

I (We), [print] _________________________________________ agree to enter into counseling to help identify the reasons and work toward a successful resolution for managing my (our) finances. I agree to attend a monthly meeting wherein I (we) will share the progress that has been made towards applying said process. As progress has been made, I (we) agree to give testimony of that progress and give God the glory for it.

I (we) have read, understand, and agree to adhere to the above on my (our) Christian word.

Name(s) ____________________________________________

Date ________________________________________________

Witness _____________________________________________